How Will the Inflation Reduction Act Affect Home Services Companies?

on February 09, 2023

In August 2022, the Inflation Reduction Act (IRA) was signed into law. The act is a new government initiative that seeks to lower healthcare costs, improve IRS funding and taxpayer compliance, and—most relevant to home service companies—decrease carbon emissions.

Under the IRA, the government is allocating $369 billion in clean energy sources and technology development to combat climate change. The goal is to reduce carbon emissions by 40% nationwide by 2030.

Of course, to reach this ambitious goal, American homes and buildings need better energy efficiency. And that’s where home service companies like yours come into the picture.

In this blog, we’ll outline the major aspects of the Inflation Reduction Act that directly affect home service companies, including:

- Energy-saving upgrade incentives for consumers

- Incentives for manufacturers of energy-efficient HVAC and solar equipment

- Policy changes and incentives for home service contractors

Let’s start by looking at each of these incentives in more detail below.

Want To Educate Your Customers About Inflation Reduction Act Incentives? Contact Rocket Media!

Our team of digital marketing experts can help you educate existing customers and gain new leads through effective content marketing, SEO, and paid search campaigns. With nearly two decades of experience working with home service companies, our digital marketing experts have the know-how and skills to help your company thrive in the new era of clean energy. Learn more about the services we offer.

Call us today at (800) 339-7305 or schedule a free consultation below.

Incentives for Consumers Under the Inflation Reduction Act

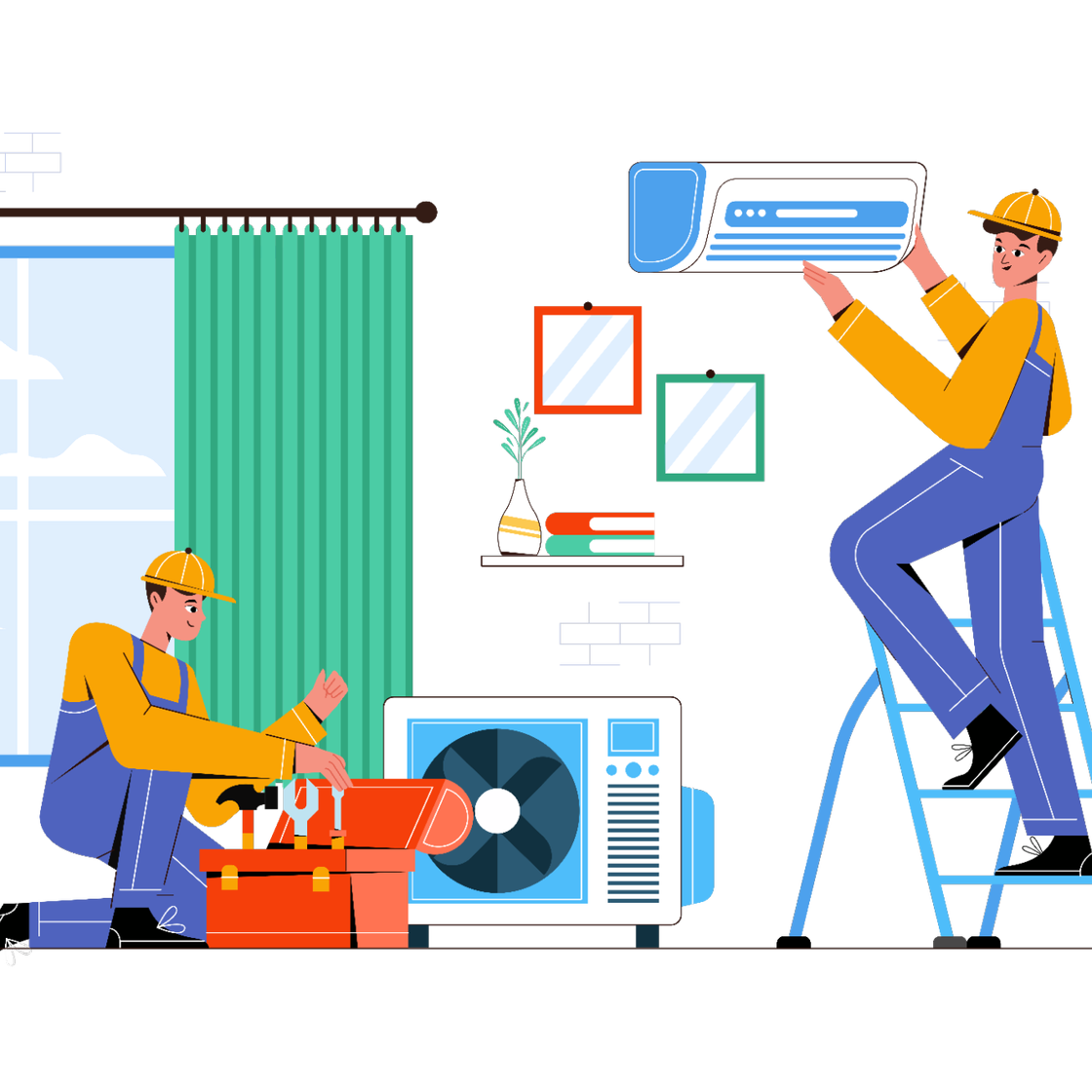

Under the IRA, homeowners have new incentives to upgrade their home’s HVAC, plumbing, and electrical systems with energy-efficient equipment. These incentives include:

- Home Owner Managing Energy Savings (HOMES) Rebate

- High-Efficiency Electric Home Rebate Act (HEEHRA)

- Tax credit programs for energy-efficient upgrades

We’ll go into more detail about how you can easily break down the Inflation Reduction Act and its consumer incentives in a digestible way for your customers.

Home Owner Managing Energy Savings (HOMES) Rebate

The HOMES rebate incentivizes homeowners to make energy-efficient upgrades that will reduce their energy usage by 20%–35%. The highest rebate savings go to homeowners who meet the 35% maximum cap.

Eligible homeowners who meet the 35% cap can receive rebates of up to 50% of the cost of the energy-saving upgrades or $4,000, whichever is less. For lower-income households (i.e., families making less than 80% of their area’s median income), the rebate increases to 80% of the project cost or $8,000, whichever is less.

That said, the details of the HOMES rebate are still pending. Right now, it’s unclear how many HOMES rebates will be available in each state and how homeowners will prove that their upgrades reduce energy usage. We’ll likely see more information about this rebate in 2023.

Learn more about the HOMES rebate on energy.gov.

High-Efficiency Electric Home Rebate Act (HEEHRA)

The HEEHRA is another incentive under the Inflation Reduction Act that directly affects HVAC and electrical service companies. The HEEHRA is a point-of-sale rebate program that aims to help individuals upgrade their home’s electrical systems to be more energy efficient.

Under the HEEHRA, eligible individuals can receive the following rebates:

- $8,000 for ENERGY STAR-certified electric heat pumps

- $4,000 for an upgraded electrical panel

- $2,500 for upgrading electrical wiring

- $1,750 for a qualifying heat pump water heater

- $1,600 for improving home insulation and sealing

Like the HOMES rebate, the HEEHRA offers the most savings to low-income households, even covering up to 100% of the upgrade cost. Moderate-income households can receive up to 50% of the upgrade cost (up to $14,000).

The HEEHRA will roll out sometime in 2023 after states apply for the program and establish additional guidelines. The program will run until 2031.

Learn more about the HEEHRA on energy.gov.

Tax Credit Programs for Energy-Efficient Upgrades

The Inflation Reduction Act renews and expands on two tax credit programs for energy-efficient upgrades:

- The Energy-Efficient Home Improvement Tax Credit (Section 25C)

- The Residential Energy Property Credit (Section 25D)

Energy-Efficient Home Improvement Tax Credit (Section 25C)

The previous iteration of this HVAC and plumbing tax credit program expired at the end of 2022 and offered a tax credit value of 10% on qualified upgrade costs. The Inflation Reduction Act extends this tax credit to 2032 and increases the tax credit value to 30%.

Qualified energy-efficient improvements include heating, cooling, or water heating equipment upgrades. The tax credit also covers insulation and other energy-efficiency improvements to a home’s roof and exterior (windows and doors).

Residential Energy Property Credit (Section 25D)

This solar tax credit was scheduled to be reduced in 2022 until it was reinstated under the IRA. Now, starting in 2023, individuals can enjoy a 30% tax credit when they install the following qualifying solar and HVAC equipment:

- Residential solar panels

- Geothermal heat pumps

- Solar water heaters (except those used for swimming pools/hot tubs)

The Residential Energy Property Credit rate is scheduled to fall to 26% in 2032 and 22% in 2034. Unless renewed by Congress, this tax credit will expire after 2034.

To learn more about these tax credits, see this report or visit energystar.gov.

With each incentive program, make sure that your company has a plan ready to go for how you will implement and promote it to prospective customers. For example, will you help homeowners fill out the paperwork? Is it a rebate that’s applied at the point of sale?

Anything you can do or say that reduces friction for customers is a massive value proposition and should be stated throughout your website content, PPC, and display (social) ad copy as a selling point.

Incentives for Manufacturers Under the Inflation Reduction Act

Because of the customer incentives above, there will be more demand for energy-efficient equipment over the next decade, from heat pumps to solar panels.

To compensate for this increased demand, the government is offering incentives for manufacturers of energy-efficient equipment. For example, the IRA allocates $10 billion for clean manufacturing investment tax credits. Manufacturers can use these tax credits to expand their clean-energy technology production facilities, including those that produce or recycle solar and qualified battery equipment. Reach out to your OEM carriers to understand which units are eligible so you can train your customer service representatives and sales teams to guide customers. They should know exactly what available equipment you have that applies to the programs.

Learn more about IRA manufacturer tax credits here.

Policy Changes and Incentives for Home Service Contractors Under the Inflation Reduction Act

Besides the incentives for consumers and manufacturers, the IRA also introduces important changes directly affecting home service contractors.

One of these changes is updating existing building energy codes so homes and businesses are more energy-efficient. The IRA is allocating $1 billion to help states and local governments adopt more advanced building energy codes, including zero-energy codes.

The IRA also includes an initiative called the State-Based Home Energy Efficiency Contractor Training Grant Program. This program allocates $200 million across states to train and educate contractors in installing qualified energy-efficient equipment and making electrical upgrades.

These grants give your company a great opportunity to educate your technicians and meet the increased demand for energy-efficient technologies. It’s unclear exactly when these grants will be available, but they are expected sometime in 2023.

Learn more about the State-Based Home Energy Efficiency Contractor Training Grant Program and updated energy code initiative here.

The Bottom Line: What the IRA Means for Your Home Service Business

Over the next ten years, energy-efficient technology will likely become more popular due to the consumer incentives in the Inflation Reduction Act. This means your company can gain new business as you lead the charge in environmentally friendly HVAC, plumbing, electrical, or solar services.

But the first step to gaining new business is educating your customers on the money-saving incentives available under the Inflation Reduction Act. One of the best ways to educate your customers is through your company’s content marketing efforts.

With a strong content marketing strategy, you can create emails, blogs, or social media posts that explain IRA incentives or answer the IRA-related questions people are searching for online. Also, including copy in your PPC and display (social) ads about your geographical location and corresponding rebates can enhance them. Not only will relevant IRA content drive more traffic to your website, but it will also set you up with high-quality leads and make you the market leader on the topic. Providing customers in your area with the information they need to make smart purchase decisions will increase their trust in your company and services, making them much more likely to work with you.

Ready To Take Your Marketing Efforts to the Next Level? Contact Rocket Media!

We can help you boost your content marketing, SEO, and paid search efforts to educate customers about incentives in the Inflation Reduction Act. With nearly two decades of experience working with home service companies, our digital marketing experts have the know-how and skills to help your company generate more leads during the new era of clean energy. Learn more about the services we offer.

Call us at (800) 339-7305 or book a free consultation for 5-star content marketing services today!